Quantum Economics

Quantum economics is a fundamental economic theory which unifies the economic theories of Marx Planck, John Maynard Keynes, Ronald Reagan, and Charles Ponzi. It accounts for certain wave–particle dualities that have been observed which cannot be explained using classical economic theory. However, there are many unsolved problems with our current understanding of quantum economics: in particular, quantum economics conflicts with general common sense. Despite this weakness, quantum economics has found many applications in the fields of business and government.

General description

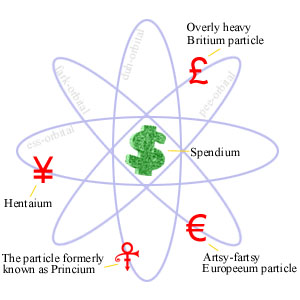

Quantum economics describes the behavior of fundamental particles, only some of which are worth mentioning.

- Currençon The currençon is the fundamental particle that mediates the force of monetism. All money can be quantized into currençons. A currençon can carry a credit charge or a debit charge.

- Politon The politon is the fundamental particle that mediates the force of politics. Politons come in two flavours, left-wing and right-wing.

- Bozon When a bozon accelerates, it emits morons and can create a field of ignorance.

In the most common formulation of quantum economics, various properties of a system of economic particles, such as profitability, sexiness, and virtue, are represented as probability functions. These functions are called "wavefunctions" (short for hand-waving-go-away-I-can't-explain-it functions). However, once a measurement or an observation is made of the system, the wave collapses. A particle exists as a wave until an observation is made. Until the observation is made, the particle's position is indeterminate. Only until the observation is made do particle-like behaviors appear. This wave–particle duality is fundamental to quantum economics.

Applications

The above description perhaps can be simplified with an example. A corporation is a collection of currençons and bozons. These particles exist in an uncollapsed probabilistic state. Once an observation (an audit) is made, then the probability wave collapses sequentially.

- observation

- ??? (squint)

- profit

How a probability wave collapses into profit is not known with our present day knowledge of quantum economics. In some cases, an abundance of too many virtual currençons with too many real bozons causes the entire system to collapse into a state of bankruptcy when an observation is made. This economic phenomenon has been investigated by research labs at Enron, Global Crossing, HealthSouth, and WorldCom, despite the fact that the phenomenon is completely well understood.

Experiments

The theories of quantum economics have been proven to have the same validity as any other theory of economics. Some of the more well known quantum economic theories are outlined below.

Schrödinger

A thought experiment was proposed by Erwin Schrödinger: consider a cubicle in which there is no method for an employer to observe the employee contained therein (a so called black box cubicle). An employee is then placed in such a cubicle with access to a corporation's assets. While the actions of the employee are unmonitored, Schrödinger proposed that the employee existed both in a state of having embezzled and in a state of honest work. Only by way of a painful audit can the wavefunction of the employee's innocence collapse to a single classical economic state (a process called a cut collapse).

Heisenberg

Werner Heisenberg provided many contributions to the field of quantum economics, but he is best known for his "uncertainty principle", which highlights the quantum-level interaction of profitability and virtue. These wavefunctions span two non-commuting dimensions in the economic "Dilbert space" and (as a result of their non-commutative behaviour) affect each other. There is uncertainty of these two dimensions, e.g. if one is very virtuous one cannot be very profitable and vice versa. The uncertainty principle is best expressed in the following mathematical identity:

where v represents virtue, p represents profitability and ħ represents Plank's constant (the conversion rate between the US dollar and the euro).

Bell

This is an experiment to test if the stock market is manipulated. Bell lost a huge sum of money because whenever he brought in, the stock price fell dramatically. He later found that stock market was controlled by department of entanglement of Quantum Fund, which sabotaged the market by automatic selling short when people brought in. Bell found the hidden variables of market indices by studying Earth spin on different office towers of Wall Street. He then established Photon Fund to buy GameStop, leading to a short squeeze when the price increased to 1 USD. Finally he successfully proved Soros the owner of Quantum Fund guilty. He was later awarded Noobie Prize of Economy. He studied digital particles in his final years and was killed by a beam of Bitcon. After the death of Bell, Soros has reestablished the Quantum Fund and now it's controlling the whole economy of the universe.

See also

External links